How to Handle Manual P2P Crypto Transactions on KoinX (with TDS & Reporting)?

In India, many crypto enthusiasts prefer peer-to-peer (P2P) trades, which involve direct, off-exchange swaps of crypto for INR, due to greater flexibility and privacy.

However, since these trades happen outside centralised platforms, you’ll need to manually reconcile them in KoinX to ensure your tax reports stay spot-on. This guide walks you through every step.

What is a Manual P2P Trade?

A manual P2P trade typically looks like this:

- Crypto Transfer: You send, say, 1 USDT from your Metamask or Trust Wallet to a buyer’s wallet address.

- Fiat Settlement: The buyer pays you in INR via UPI, IMPS, NEFT, etc.

- TDS Deduction (if any): Under Indian law, the buyer may deduct 1 % TDS at source before sending you the net amount.

Because these transactions bypass an exchange’s order book, they won’t automatically register as a “sell” in KoinX. Instead, you’ll often see them labelled as “Withdraw” or “Transfer.”

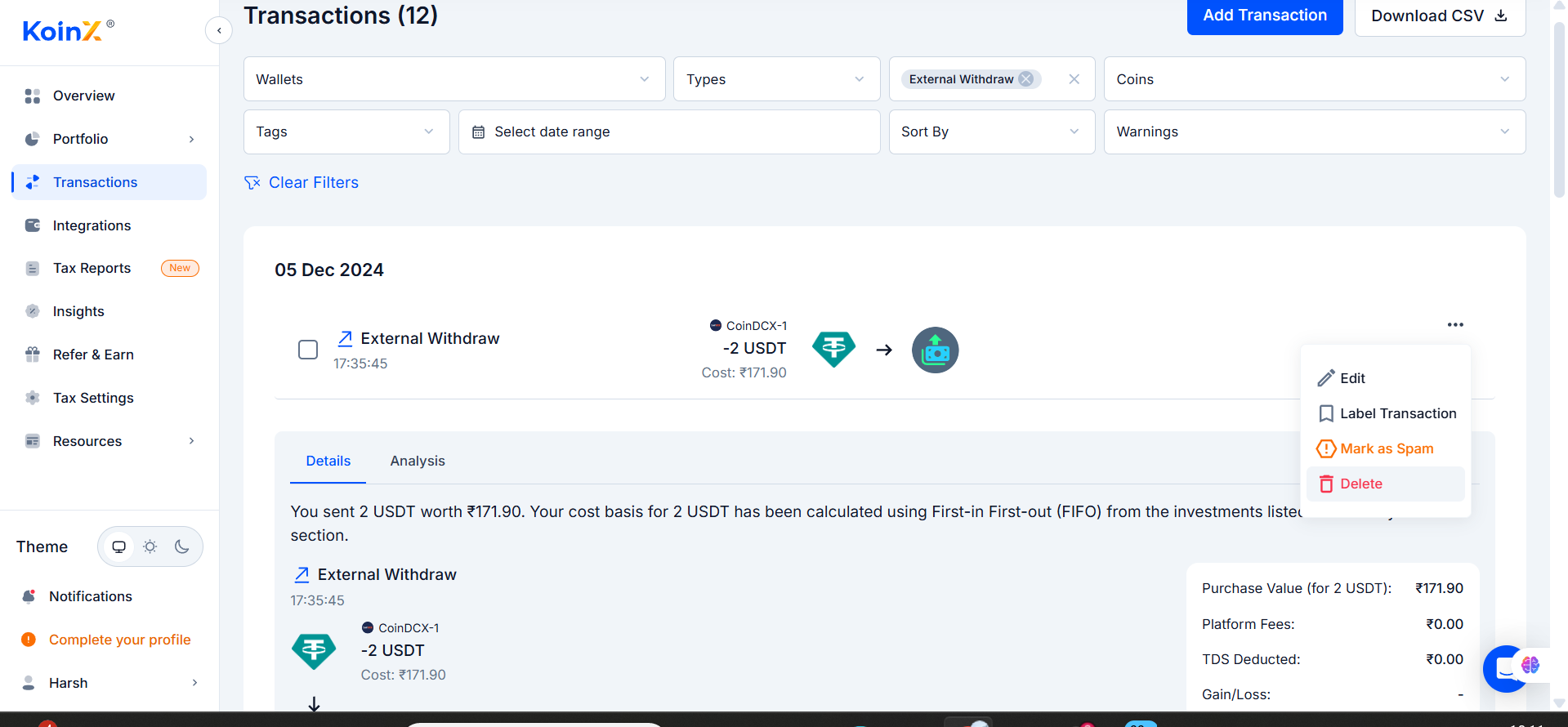

How Do These Transactions Appear on KoinX?

When you import your on-chain history into KoinX, outgoing crypto movements show up as “Transfer” (or sometimes “Withdraw”).

Since you have already sold the asset for INR, it is now your responsibility to report it as a sale and remove the auto-fetched entry.

Step-by-Step: Recording Manual P2P Sales

Delete the Auto-Fetched Transaction

- Go to Transactions.

- Find the “Withdraw”/“Transfer” entry for your P2P transaction.

- Click Delete to remove it (this prevents duplicate records).

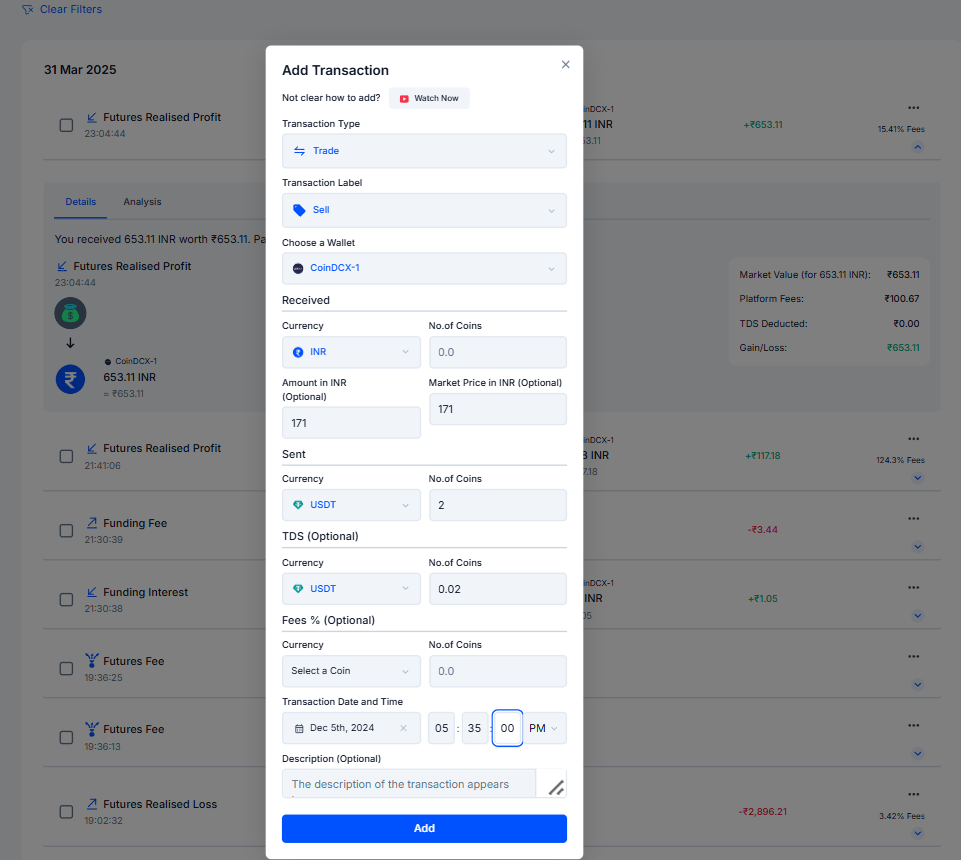

Manually Add a “Sell” Trade

Now you have to add all the details manually:

- Date: Date of your P2P trade

- Asset: e.g., USDT

- Quantity Sold: Amount you sent (e.g., 1 USDT)

- INR Received: Gross INR amount credited to you

- TDS Deducted: If the buyer withheld 1 % TDS (e.g., ₹1 on ₹100 sale)

- Transaction Hash (Optional): On-chain TxID for audit trail

- Note (Optional): “Manual P2P sale: 1 USDT → ₹100 via UPI; ₹1 TDS”

KoinX will now treat this as a taxable sale, correctly calculating your capital gains and income.

Understanding TDS in P2P Trades

- Buyer’s Responsibility: Under Section 194S, the buyer must deduct 1 % TDS on crypto purchases.

- PAN Requirement: If the buyer has your PAN, they’ll deposit TDS under your name, which will be visible in Form 26AS.

- Self-Assessment: If no TDS was deducted, you’re responsible for paying it directly when filing.

- KoinX Support: By manually entering the TDS amount in each “Sell” trade, KoinX will include it in your tax summary and Form 16B reporting.

Conclusion

Manual P2P trades are a popular way to swap crypto for INR, but without proper classification, they can spoil your tax reporting.

By deleting the auto-fetched transfer, adding a precise “Sell” entry, and recording any TDS, you ensure KoinX delivers accurate capital-gains numbers and tax-compliance forms.