Detailed End of Year Balance of Assets Report

Understanding Your End of Year Balance of Assets Report

The Detailed End of Year Balance of Assets Report from KoinX gives you a snapshot of your crypto holdings at the end of the financial year. It shows your asset balances, their acquisition cost, and their value, helping you track and report your portfolio accurately.

Note: The disclaimers and the currency in the report will vary depending on your country. Your report will automatically adapt to your local tax jurisdiction.

Sample Report: KoinX Detailed End of Year Balance of Assets Report (opens in a new tab)

What the Report Includes

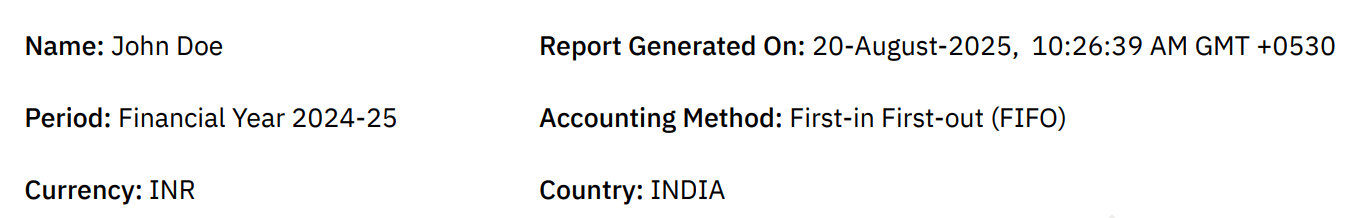

At the beginning, the report contains key details such as:

- User name

- User Country

- Currency used for calculations (e.g., INR, USD)

- Accounting method (e.g., FIFO, Share Pooling, etc.)

- Financial year covered

- Report generation date and time

Why This Report is Useful

- Portfolio Tracking – See your crypto balances at year end

- Tax Filing Support – Provides ending values used to calculate gains/losses

- Audit Readiness – Keeps a verifiable record of holdings at year end

- Compliance – Uses cost-basis methods aligned with your country’s tax regulations

Key Terms in the Report

- Asset Name → The cryptocurrency you hold (e.g., BTC, ETH, MATIC)

- Quantity → The number of coins/tokens you hold at year end

- Cost → The acquisition cost of those assets

- Value → The market value at the end of the financial year

- Remarks → Additional notes such as the average cost per coin

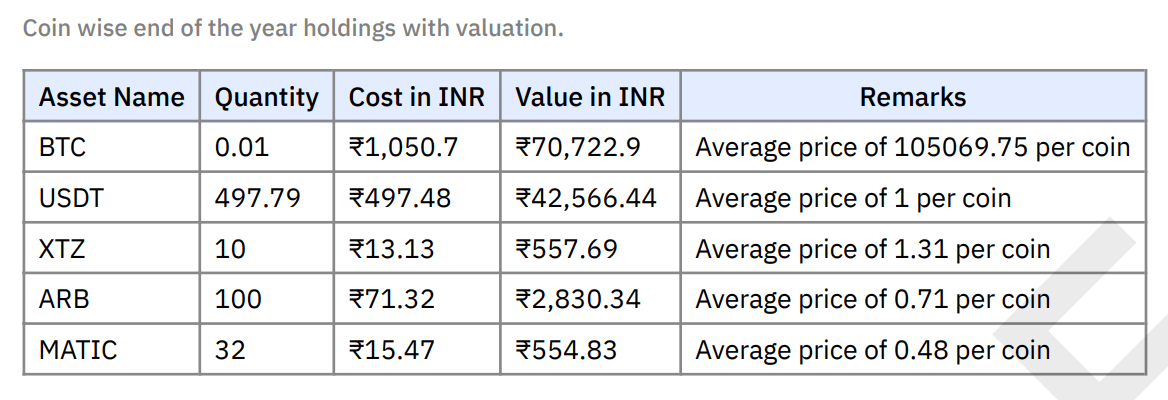

Example from Report

| Asset Name | Quantity | Cost | Value | Remarks |

|---|---|---|---|---|

| BTC | 0.01 | 843.44 | 635.19 | Average price of 84344.13 per coin |

| USDT | 507.79 | 408.22 | 387.67 | Average price of 0.8 per coin |

| ARB | 100 | 58.46 | 23.71 | Average price of 0.58 per coin |

| MATIC | 32 | 10.25 | 4.66 | Average price of 0.32 per coin |

| XTZ | 35 | 7.95 | 17.35 | Average price of 0.23 per coin |

This shows your crypto holdings at the end of the financial year.

- The total acquisition cost reflects what you paid for these assets

- The market value shows what they were worth at year end

- Each coin’s value is calculated as an average price per unit

Where Can You Use This Report?

- To file taxes, since it provides ending values for capital gains calculations

- To share with your accountant/tax professional for year-end reporting

- During a tax audit, as proof of your ending balances

- For personal tracking, to compare portfolio growth from start to end of year

The End of Year Balance of Assets Report is a key tool for crypto investors and traders. It clearly shows your holdings at the end of a financial year, ensuring accuracy in tax reporting and helping you track portfolio performance over time.