Income Summary Report

When you generate an Income Summary Report on KoinX, you get a consolidated overview of all the crypto income you earned during the year. This report is designed to give both you and your tax professional a clear picture of your income streams - including capital gains from trading, derivative income, staking rewards, airdrops, and other earnings - so you can stay compliant and organized.

Note: The disclaimers and self-filing tips in the report may change depending on your country of residence. KoinX automatically adapts them to match your local tax requirements.

What the Report Includes :

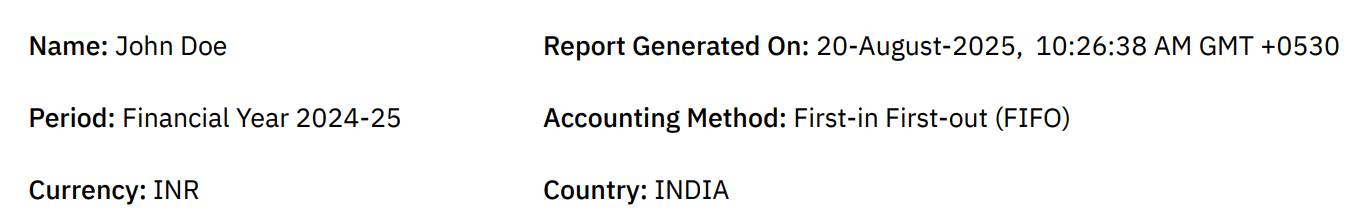

At the beginning, the report highlights key details:

- User name

- Country

- Currency used for calculations

- Accounting method (e.g., FIFO – First In, First Out)

- Financial year covered

- Report generation date and time

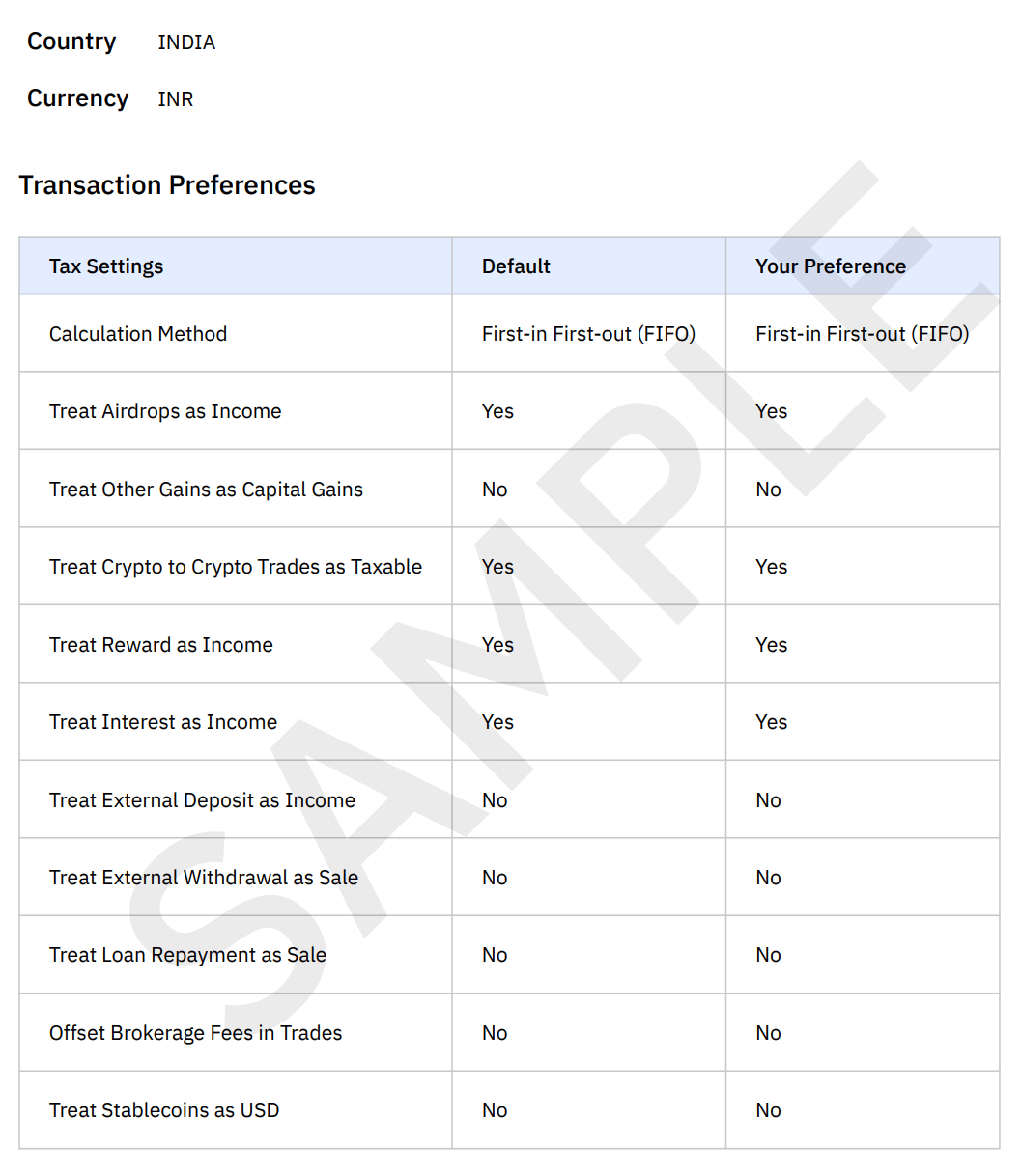

Tax Settings and Customizations

This section shows the tax configuration applied while generating the Income Summary Report. These settings directly impact how income and gains are classified and calculated.

It includes:

- Selected country: India

- Reporting currency: INR

- Accounting method: First-in First-out (FIFO) (As per user choose in Tax Settings)

Transaction treatment preferences such as:

- Treat Airdrops as Income

- Treat Rewards as Income

- Treat Interest as Income

- Treat Crypto-to-Crypto Trades as Taxable

- Treatment of external deposits, withdrawals, loan repayments

- Brokerage fee offset preferences

- Stablecoin treatment

These settings reflect whether the user has made any changes from KoinX’s default tax recommendations.

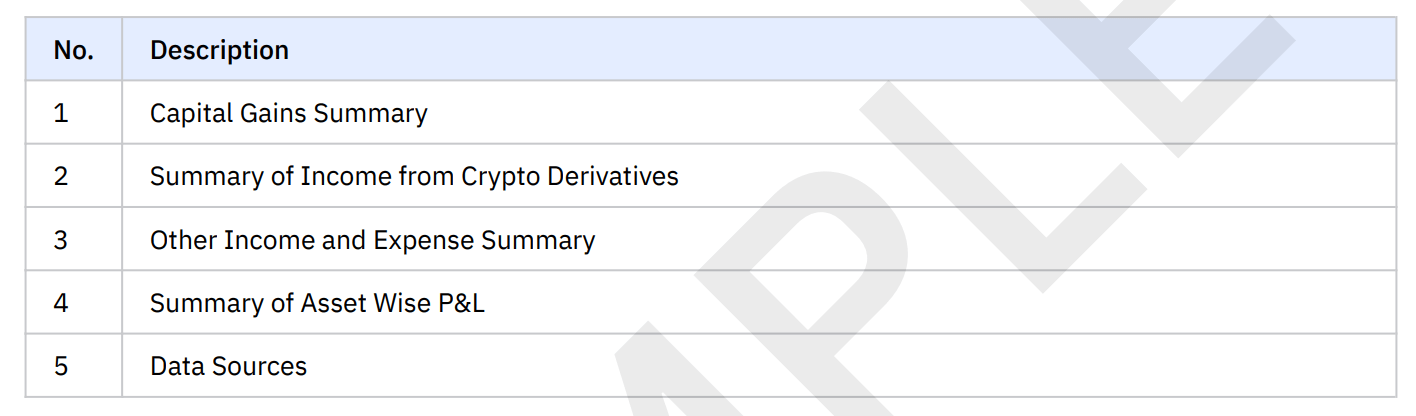

Sections Inside the Report :

- Capital Gains Summary – Shows profits and losses from crypto transfers, including spot, P2P, and margin trades.

- Crypto Derivatives Income – A breakdown of realised profits, losses, fees, and interest from futures and options trading.

- Other Income & Expenses – Details income earned through airdrops, staking, rewards, mining, salary/consultancy payments, along with expenses, donations, and fees.

- Asset-wise P&L – A coin-by-coin summary of gross profits, losses, and net gains.

- Data Sources – Lists the exchanges, wallets, and files that contributed to the report.

Why This Report is Useful :

- Comprehensive Income View – Consolidates all income types (capital gains, derivatives, staking, mining, etc.) in one place.

- Tax Filing Support – Gives a structured overview to simplify filing with your accountant or tax advisor.

- Audit Readiness – Provides transparent and regulator-friendly details.

- Portfolio Insights – Helps you see which assets or income types are contributing most to your gains.

Key Terms in the Report :

- Capital Gains → Profits or losses from selling or swapping crypto.

- Derivatives PnL → Net income from trading crypto futures and options.

- Airdrops / Rewards / Staking → Tokens received without direct purchase, counted as income.

- Mining Income → Rewards earned from mining activity.

- Consultancy / Salary Income → Payments received in crypto for professional or employment services.

- Expenses → Fees, donations, or costs deducted from income.

- Asset-wise P&L → Coin-by-coin calculation of gains/losses.

Examples

Example 1: Capital Gains

| Asset | Date of Acquisition | Date of Transfer | Cost of Acquisition | Sale Consideration | Taxable Capital Gain |

|---|---|---|---|---|---|

| MATIC | 01-07-2024 | 03-07-2024 | 3.5 | 14.99 | 11.49 |

Bought MATIC for 3.5 and sold for 14.99 → Profit = 11.49

Example 2: Derivatives (Futures)

| Asset | Realised Profit | Realised Loss | Net Gains (after fees) |

|---|---|---|---|

| USDT Futures | 99.98 | 9.99 | 89.79 |

Traded USDT futures → Gross gain of 99.98, losses of 9.99, after fees Net = 89.79

Example 3: Other Income

| Source | Amount |

|---|---|

| Airdrops | 71.32 |

| Staking | 14.09 |

| Salary Income | 318.50 |

| Consultancy Income | 999.39 |

| Mining | 1,050.70 |

Total crypto income from other sources = 2,463.47

Example 4: Asset-wise P&L

| Asset | Gross Profit | Gross Loss | Net Gain |

|---|---|---|---|

| BTC | 1,050.70 | 0 | 1,050.70 |

| USDT | 1,199.43 | 609.89 | 589.54 |

| ETH | 318.50 | 0 | 318.50 |

Self Filing Tips

The report will also contain self-filing tips that adapt based on your country’s tax system (if applicable). These tips guide you on how different income types (capital gains, derivatives, or staking rewards) may be treated under your local rules.

The Income Summary Report is your one-stop document for understanding of your annual crypto income. By consolidating capital gains, derivative PnL, staking, mining, and other income sources, it ensures you and your tax advisor have everything needed for compliance and clarity.