Transaction History Report

When you generate a Transaction History Report on KoinX, you receive a detailed, line-by-line record of every crypto transaction carried out during the selected financial year. This report is the foundation of your tax calculations, giving you full transparency on how each trade, transfer, or income event is recorded.

Note: The format of this report remains the same for users across all countries. However, not every column may be relevant for your local tax laws. KoinX will only fill the columns that are applicable in your tax country - the rest will remain blank.

What the Report Includes

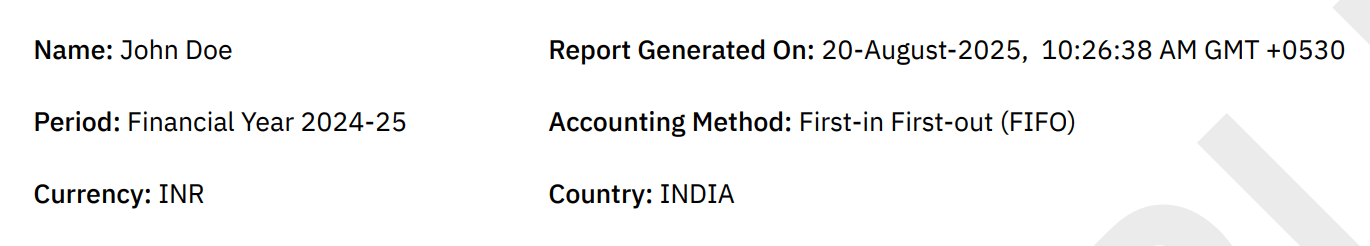

At the beginning, the report highlights key details:

- User name

- Country

- Currency used for calculations

- Accounting method (e.g., FIFO, UK Share Pooling, etc.)

- Financial year covered

- Report generation date and time

Key Terms in the Report

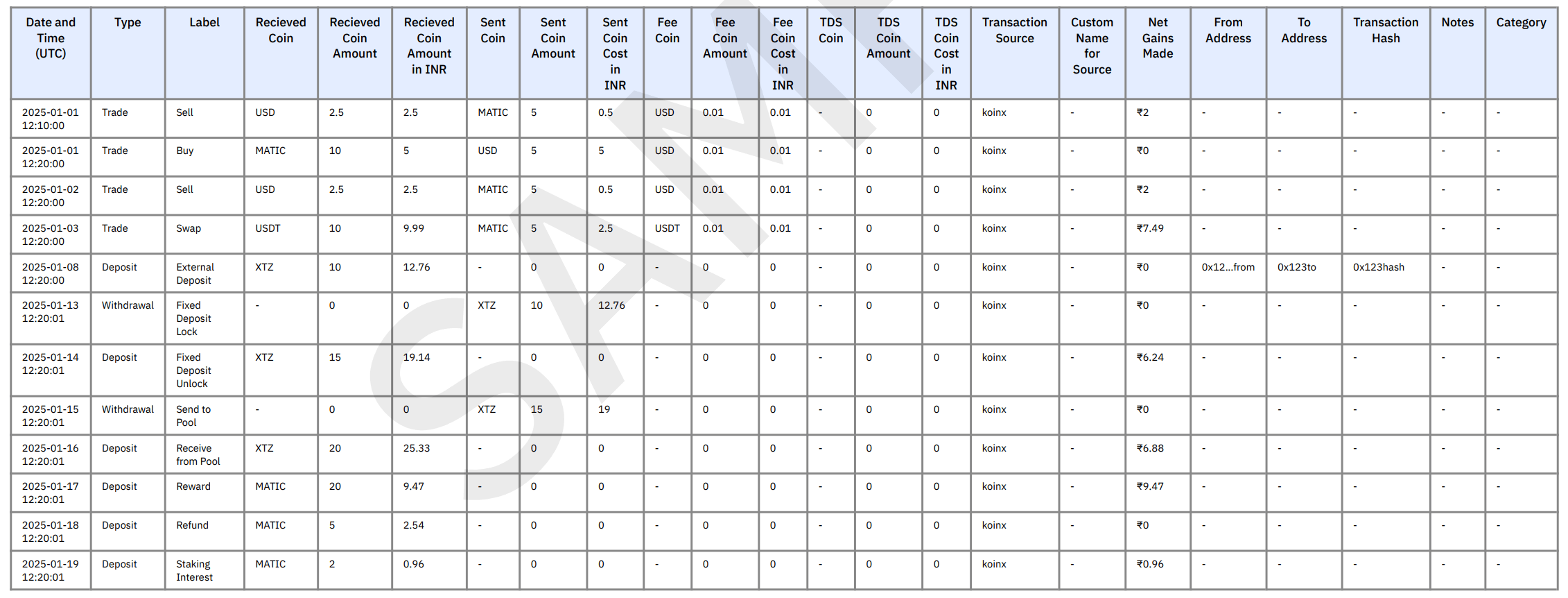

Here’s a breakdown of the important fields you’ll see in the Transaction History table:

- Date and Time (UTC) → Exact timestamp of the transaction.

- Type → The type of transaction (e.g., Trade, Deposit, Withdrawal, Airdrop, etc.).

- Label → Additional context for the transaction (e.g., Buy, Sell).

- Received Coin → The cryptocurrency received in this transaction.

- Received Coin Amount → Quantity of crypto received.

- Received Coin Amount in your selected currency → The fair market value of the crypto received, converted into your selected currency (such as INR, EUR, USD).

- Sent Coin → The cryptocurrency you sent or disposed of.

- Sent Coin Amount → Quantity of crypto sent.

- Sent Coin Cost → Original cost basis of the crypto sent.

- Fee Coin → The cryptocurrency used to pay transaction fees.

- Fee Coin Amount → Quantity of fee charged.

- Fee Coin Cost → Value of the fee in your selected currency.

- TDS Coin / TDS Coin Amount / TDS Coin Cost → Withholding tax deducted at source (only relevant for India).

- Transaction Source → Platform or exchange where the transaction occurred.

- Custom Name for Source → Name of the integration that contains this transaction

- Net Gains Made → The profit or loss realized on that transaction.

- From Address → Blockchain address from which the funds originated (for transfers).

- To Address → Blockchain address where the funds were sent.

- Transaction Hash → Unique identifier of the transaction on the blockchain.

- Notes → Information for any error such as missing price or acquisition history.

Why This Report is Useful

- Complete Audit Trail – Every transaction is listed with timestamps and details.

- Error Checking – Useful to spot any errors such as Missing Price or Acquisition History.

- Universal Format – Provides consistency across countries, while letting users focus only on the fields relevant for their tax filing.

KoinX follows a universal format for the Transaction History Report.

- Only the columns relevant to your tax country will be filled with data.

- The irrelevant columns will remain blank.

- If you are unsure about how to use the report for filing, you can always consult with a qualified tax advisor.