Schedule VDA Derivatives Report

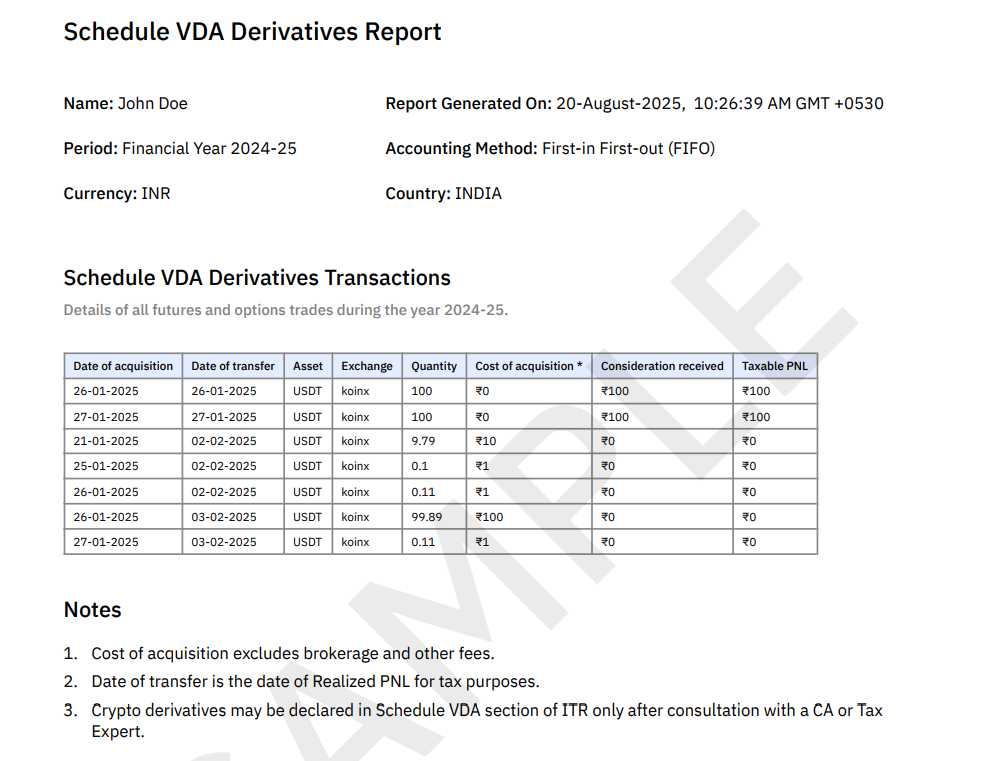

When you generate a Schedule VDA Derivatives Report on KoinX, you receive a detailed summary of all your crypto futures and options transactions for the selected financial year. This report is designed to give you (and your tax professional) a clear, audit-ready overview of your derivatives activity to ensure compliance with local tax regulations.

Note: The structure and disclaimers in the report may vary depending on your selected Tax Country. KoinX automatically adjusts them based on local jurisdiction.

Sample Report: Schedule VDA Derivatives.pdf (opens in a new tab)

What the Report Includes

At the beginning, the report highlights key details such as:

- User name

- Country → India

- Currency → INR

- Accounting method → FIFO (First-In First-Out)

- Financial year covered

- Report generation date and time

Why This Report is Useful

- Derivatives-specific compliance – captures all futures and options trades under Schedule VDA for tax filing

- Audit-ready format – structured presentation for regulators and tax professionals

- Accurate P&L reporting – shows cost of acquisition, consideration received, and taxable P&L

- Transparency for users – simplifies complex derivatives data into a clear, standardized format

Key Terms in the Report

- Date of acquisition → When the derivative contract was entered

- Date of transfer → When the position was closed / Realized PNL was booked

- Asset → Underlying cryptocurrency in the contract (e.g., USDT)

- Exchange → Platform where the trade occurred

- Quantity → Number of units/contracts involved

- Cost of acquisition → Entry value (excludes brokerage and fees)

- Consideration received → Value on transfer/closure of the contract

- Taxable PnL → Profits/losses realized and relevant for tax calculation

Example Transactions

Example 1: Same-Day Futures Trade

| Date of Acquisition | Date of Transfer | Asset | Exchange | Quantity | Cost of Acquisition | Consideration Received | Taxable PnL |

|---|---|---|---|---|---|---|---|

| 26-01-2025 | 26-01-2025 | USDT | KoinX | 100 | ₹0 | ₹100 | ₹100 |

Here, 100 USDT worth of contracts were acquired and squared off the same day, resulting in a realized taxable gain of ₹100.

Example 2: Futures Position Carried Forward

| Date of Acquisition | Date of Transfer | Asset | Exchange | Quantity | Cost of Acquisition | Consideration Received | Taxable PnL |

|---|---|---|---|---|---|---|---|

| 21-01-2025 | 02-02-2025 | USDT | KoinX | 9.79 | ₹10 | ₹0 | ₹0 |

In this case, the derivative was acquired on 21st Jan and closed on 2nd Feb with no consideration received, resulting in no taxable gain.

Where Can You Use This Report?

- Filing crypto derivative income in your ITR (Schedule VDA section)

- Sharing with your CA or tax advisor for accurate reporting

- Submitting during a tax audit or compliance check

- Keeping precise personal records of futures and options trades

The Schedule VDA Derivatives Report provides a transparent and well-structured view of your crypto futures and options activity. Whether you are entering short-term trades or carrying positions forward, this report ensures every transaction is documented for compliance and clarity.