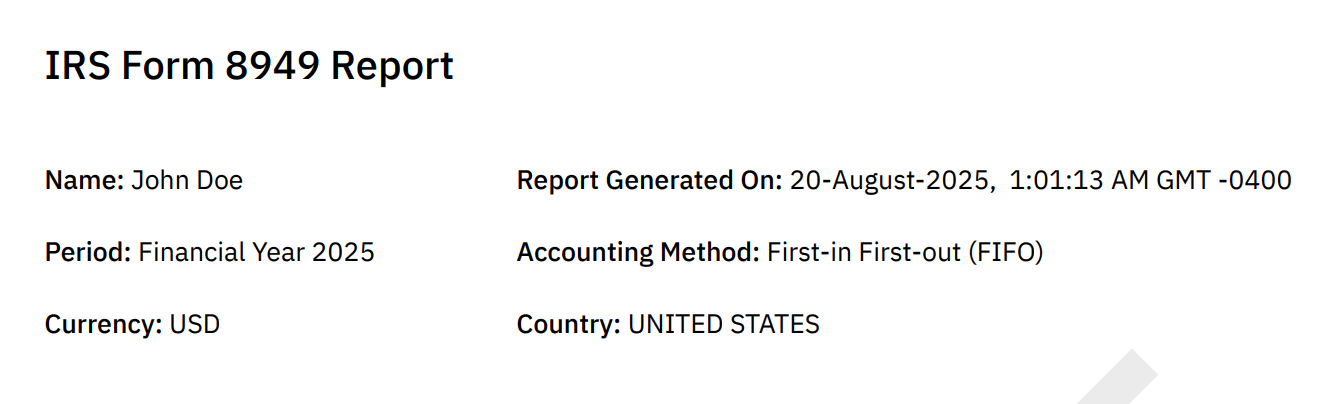

IRS Form 8949 Report

When you generate an IRS Form 8949 Report from KoinX, it gives you a structured overview of your crypto disposals, capital gains, and losses for the financial year. This report is built to help U.S. taxpayers stay compliant with IRS rules and simplifies the process of filling Form 8949 and Schedule D for crypto taxes.

What the Report Includes

At the beginning, the report shows key information:

- User name

- Country : United States

- Currency : USD

- Accounting Method : First‑in First‑out (FIFO)

- Financial Year covered

- Report generation date and time

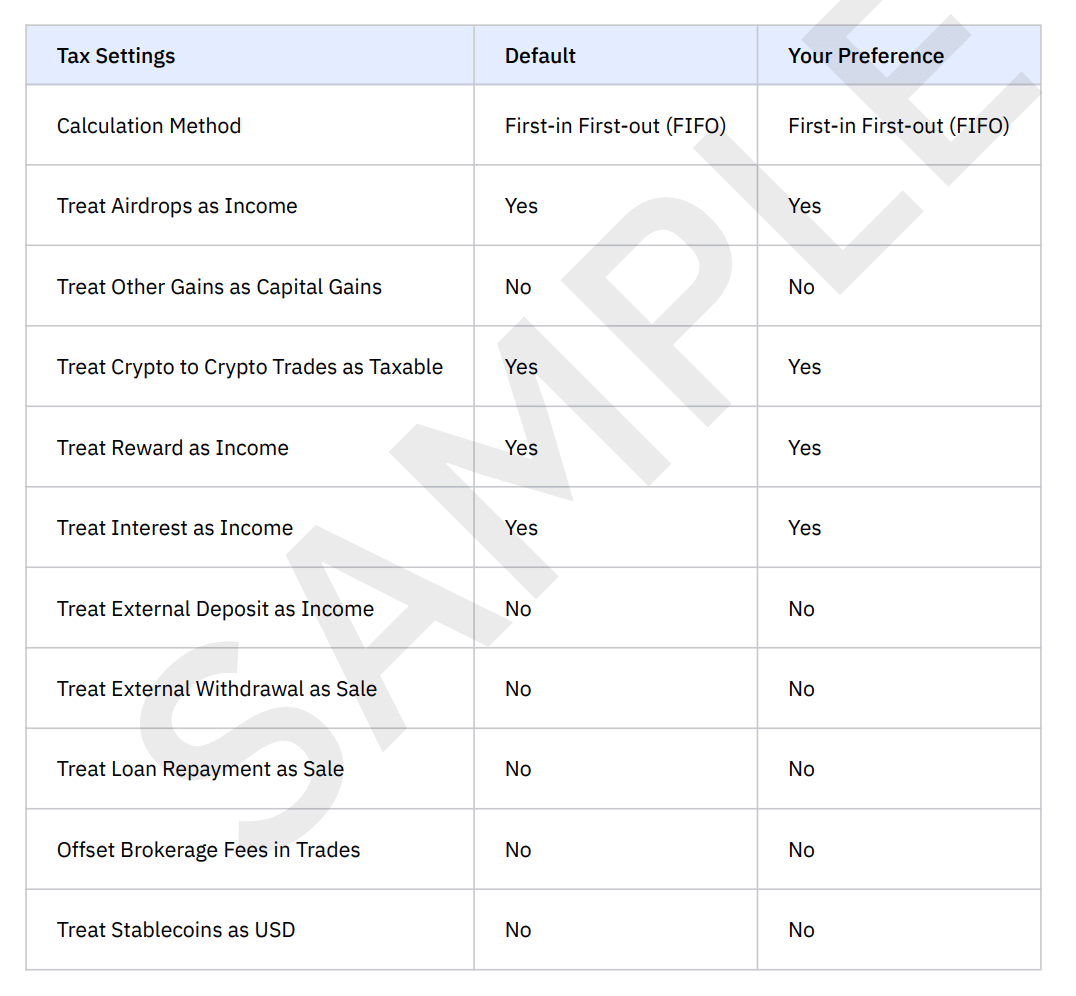

Tax Settings and Customizations

It also highlights your tax treatment preferences set during the calculation.

- Calculation Method: FIFO (First In, First Out)

- Treat Airdrops as Income: Yes/No

- Treat Rewards as Income: Yes/No

- Treat Interest as Income: Yes/No

- Treat Crypto to Crypto Trades as Taxable: Yes/No

- Treat Other Gains as Capital Gains: Yes/No

- Treat External Deposits as Income: Yes/No

- Treat External Withdrawals as Sale: Yes/No

- Treat Loan Repayment as Sale: Yes/No

- Offset Brokerage Fees in Trades: Yes/No

- Treat Stablecoins as USD: Yes/No

IRS Form 8949 Data

This section provides a complete overview of capital gains and losses from cryptocurrency transactions, structured exactly as required for IRS Form 8949.

Transactions are divided into Short Term and Long Term categories based on the holding period of the asset.

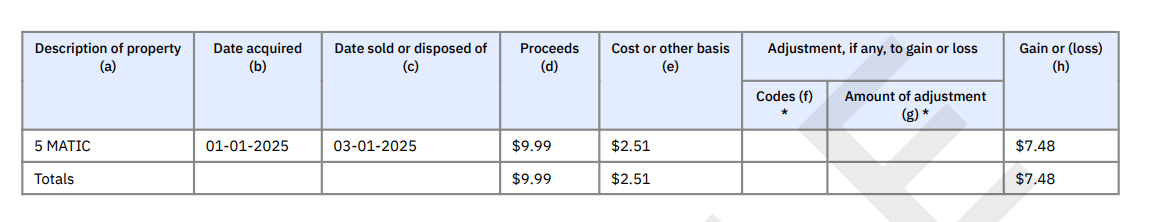

Short Term

This subsection includes transactions involving capital assets held for 1 year or less, which are generally treated as Short Term capital gains or losses under IRS rules.

For each transaction, the following details are shown:

- Description of property

- Date acquired

- Date sold or disposed of

- Proceeds

- Cost or other basis

- Adjustment, if any, to gain or loss

- Codes (if applicable)

- Amount of adjustment (if applicable)

- Gain or (loss)

A totals row is provided at the end of the Short Term section summarizing:

- Total proceeds

- Total cost or other basis

- Total short-term gain or loss

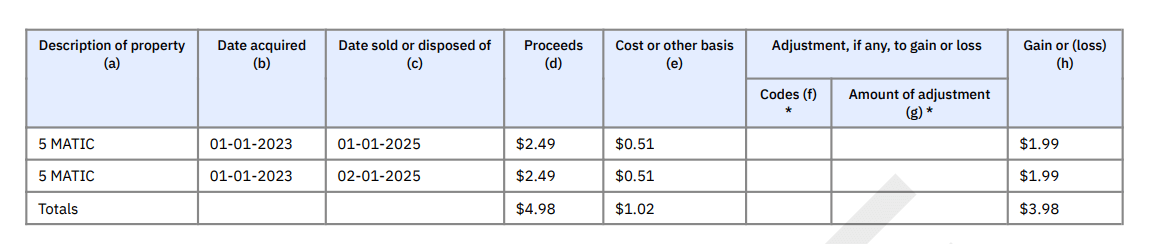

Long Term

This subsection includes transactions involving capital assets held for more than 1 year, which are generally treated as Long Term capital gains or losses under IRS rules.

For each transaction, the following details are shown:

- Description of property

- Date acquired

- Date sold or disposed of

- Proceeds

- Cost or other basis

- Adjustment, if any, to gain or loss

- Codes (if applicable)

- Amount of adjustment (if applicable)

- Gain or (loss)

A totals row is provided at the end of the Long Term section summarizing:

- Total proceeds

- Total cost or other basis

- Total long-term gain or loss

Self‑Filing Tips

The report notes that certain adjustments need to be entered manually, based on the Form 1099‑B you receive from your exchange or broker.

How to Fill the Adjustments Column:

- Get the 1099‑B form from your exchange or broker.

- Identify adjustments related to your transactions.

- Enter the adjustment amount and codes in the relevant column.

- Use this data to complete IRS Form 8949 & Schedule D.

Notes and Disclaimers

- All fiat currency values are in USD unless otherwise stated. Capital gains and losses are calculated using the First‑in First‑out (FIFO) cost basis method.

- Assets held for over 1 year are reported as ‘Long Term’ capital gains, while assets held for 1 year or less are shown as ‘Short Term’ gains.

- Market prices are based on the average market value at acquisition/disposal, unless explicitly reported by the trading platform or overridden. All dates and times are displayed in the GMT ‑0400 timezone.

- The calculated results in this report are based on user‑provided information and should be considered estimates only. It is strongly advised to verify results and consult a qualified tax professional.

- Since tax laws change often, this report should only be used as a supporting tool for tax compliance. KoinX is not a tax advisor or tax preparer.

Why This Report is Useful

- IRS Compliance → Data is formatted exactly for Form 8949 & Schedule D.

- Short‑term vs. Long‑term clarity → Helps you separate taxable disposals by holding period.

- Audit‑ready → Provides transaction details for IRS verification.

- Tax filing support → Ensures you have the correct numbers for gains and losses.

The IRS Form 8949 Report helps you track every crypto disposal event, separate gains into short‑term and long‑term categories, and prepare audit‑ready figures in line with IRS reporting requirements.