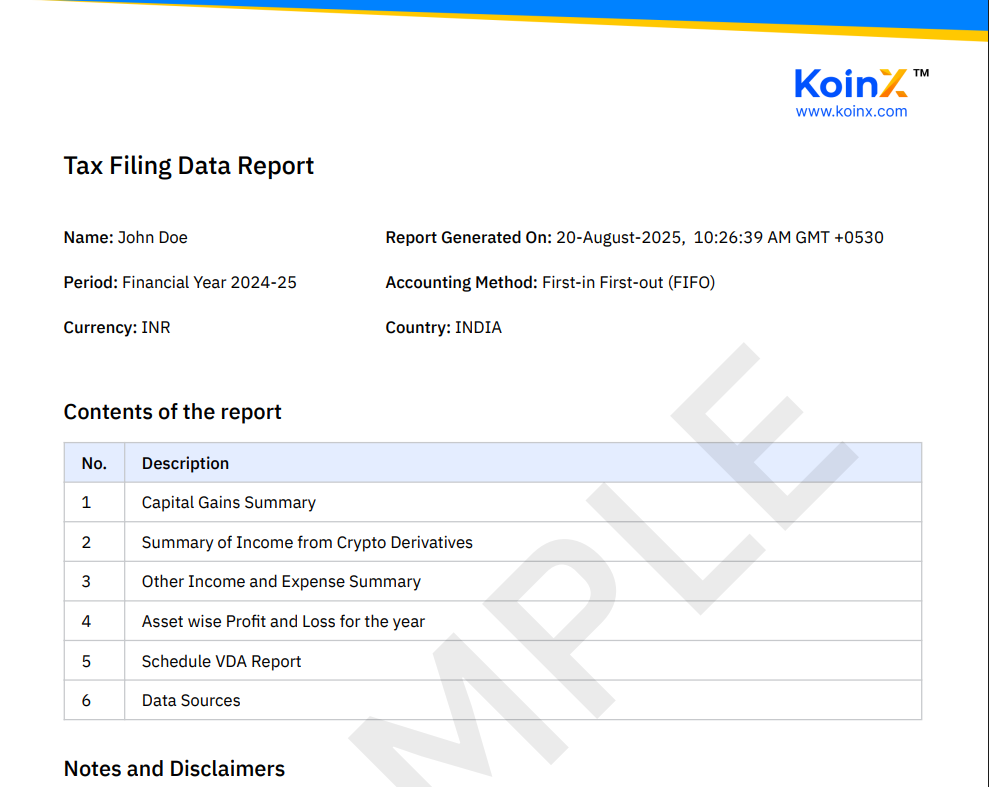

Tax Filing Data Report

When you generate a Tax Filing Data Report on KoinX, you receive a complete breakdown of your crypto-related income, capital gains, and expenses for the financial year. This report is tailored to Indian tax laws and helps you (and your Chartered Accountant) prepare and file an accurate Income Tax Return (ITR), including Schedule VDA disclosures.

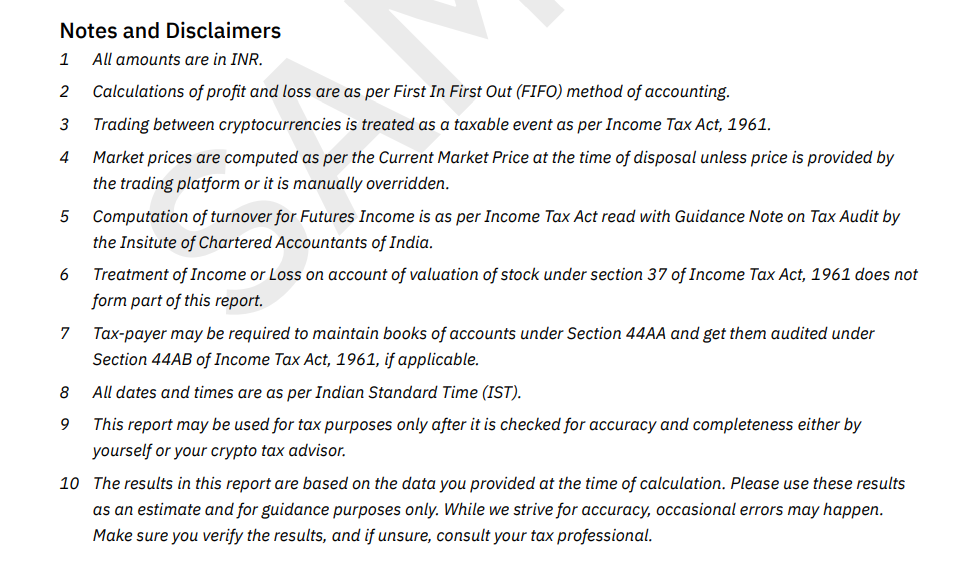

Note: This report is structured according to the Income Tax Act, 1961.

Sample Report: Tax Filing Report.pdf (opens in a new tab)

What the Report Includes

At the beginning, the report outlines key details such as:

- User name

- Country → India

- Currency → INR

- Accounting method → FIFO (First-In First-Out)

- Financial year covered

- Report generation date and time

- Tax settings applied (e.g., treatment of staking, airdrops, and crypto-to-crypto trades)

Sections Covered in the Report

- Capital Gains Summary – profit and loss from transfers of crypto assets in Spot, P2P, and Margin markets

- Crypto Derivatives Income – realized PnL, turnover, and brokerage on futures & options trades

- Other Income and Expense Summary – includes airdrops, rewards, staking, mining, salary/consultancy income, and related expenses

- Asset-Wise Profit & Loss – coin-wise breakdown of profits and losses

- Schedule VDA Report – detailed listing of all crypto transfers, formatted as per Schedule VDA of ITR

- Data Sources – list of exchanges, wallets, and custom files from which data was imported

Why This Report is Useful

- ITR Ready – specifically designed for India’s Schedule VDA requirements

- Comprehensive Coverage – consolidates gains, derivative PnL, staking, mining, salary, and rewards

- Audit-Friendly Format – easy for CAs and regulators to verify

- Accurate Turnover Reporting – computed as per ICAI Guidance Note for tax audit applicability

- Time-Saving – eliminates manual reconciliations and ensures accuracy in reporting

Key Terms in the Report

- Capital Gains → Taxed at 30% plus surcharge and cess; no set-off of losses is allowed

- Derivatives Income → Typically disclosed as Business Income (PGBP), eligible for expense deduction and loss set-off (on advice of a CA)

- Other Income → Airdrops, rewards, staking, mining, salary, consultancy, etc.

- Turnover → Calculated as per ICAI guidelines to determine tax audit thresholds

- Schedule VDA Transactions → Mandatory section in the ITR to disclose all Virtual Digital Asset transactions

Example Sections

Example 1: Capital Gains Summary

| Label | Amount |

|---|---|

| Sale Consideration | ₹14.99 |

| Cost of Acquisition | ₹3.5 |

| Taxable Capital Gains | ₹11.49 |

Self-Filing Tip:

- No set-off of any loss is allowed (even within the same coin/pair)

- Gains are taxed at a flat 30% plus surcharge & 4% cess

- Losses cannot be carried forward to future years

Example 2: Other Incomes

| Income Type | Amount |

|---|---|

| Airdrops | ₹71.32 |

| Rewards | ₹9.47 |

| Mining | ₹1,050.7 |

Self-Filing Tip:

- Income from airdrops, staking, and mining must be disclosed under Other Income in ITR

- Expenses directly related (like mining costs, consultancy) may be considered depending on applicability

Where Can You Use This Report?

- Filing your Income Tax Return in India with accurate Schedule VDA disclosures

- Sharing with your CA or tax consultant for review and validation

- Submitting during a tax audit under Section 44AB if turnover thresholds are crossed

- Maintaining a clear record of crypto income and capital gains

The Tax Filing Data Report is your India-specific crypto compliance report, combining capital gains, derivatives income, other incomes, and Schedule VDA details into one structured document. It ensures every income source is covered, making your ITR filing accurate, compliant, and audit-ready.