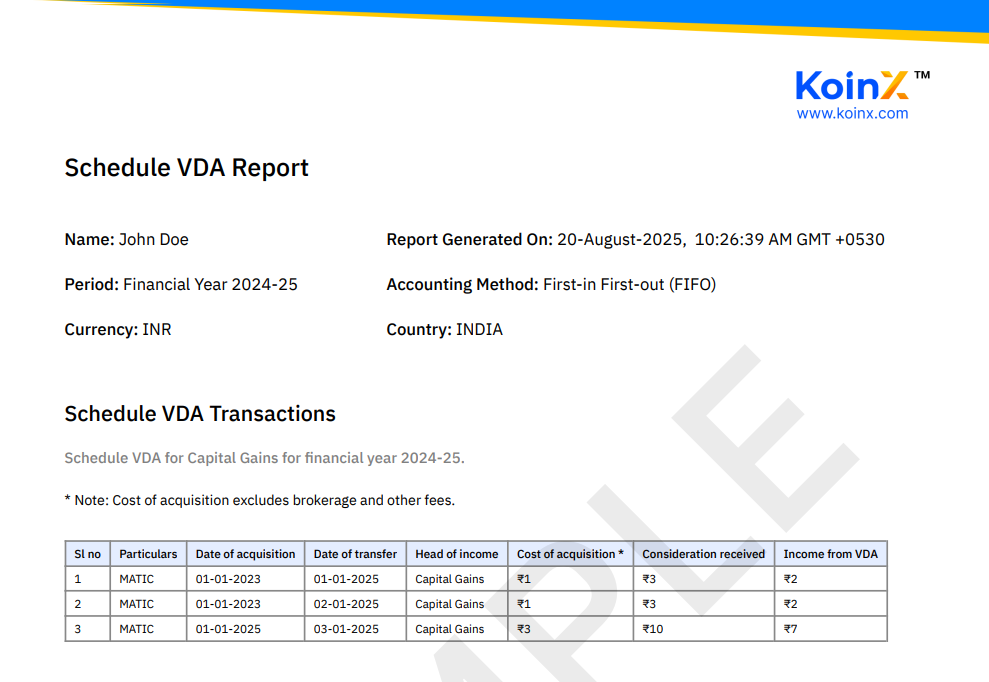

Schedule VDA Report

Understanding Your Schedule VDA Report : When you generate a Schedule VDA Report on KoinX, you get a structured summary of your crypto activity for a financial year. It provides you (and your tax professional) with an audit-ready view of transactions so you can stay compliant with your local tax rules.

⚠️ Note: The disclaimers in the report change depending on your country of residence. KoinX automatically adapts them to match your local jurisdiction.

Sample Report: Schedule VDA Report.pdf (opens in a new tab)

What the Report Includes

At the beginning, the report shows key details:

- User name

- Country → India

- Currency → INR

- Accounting method → FIFO (First-In First-Out)

- Financial year covered

- Report generation date and time

Why This Report is Useful

- Tax filing support – shows profits, losses, and taxable income

- Audit readiness – gives a structured, regulator-friendly format

- Portfolio clarity – helps you understand PnL on each disposal event

Key Terms in the Report

- Date of Acquisition → When you first acquired the asset

- Date of Transfer → When you disposed of it (sell, swap, use)

- Asset → Cryptocurrency involved (BTC, ETH, MATIC, etc.)

- Exchange → Platform where the trade took place

- Quantity → Amount of asset involved

- Cost of Acquisition → What you paid to acquire the asset (can be 0 in futures)

- Consideration Received → Value you got when disposing of the asset

- Income from VDA → Profit or loss subject to tax under your local rules

Examples :

Example 1 - Spot Trade (Capital Gains)

| Asset | Date of Acquisition | Date of Transfer | Cost of Acquisition | Consideration Received | Income from VDA |

|---|---|---|---|---|---|

| MATIC | 01-07-2023 | 03-07-2023 | 3 | 863 | 860 |

Bought MATIC for 3 on 1st July 2023.

Sold on 3rd July 2023 for 863.

Taxable Profit = 860

Example 2 - Derivatives Trade (Futures/Options)

| Asset | Date of Acquisition | Date of Transfer | Quantity | Cost of Acquisition | Consideration Received | Income from VDA |

|---|---|---|---|---|---|---|

| USDT | 07-07-2023 | 07-07-2023 | 50 | 0 | 4,329 | 4,329 |

Executed a futures trade on 7th July 2023.

No acquisition cost recorded (0).

Settlement gave 4,329.

Entire amount is taxable profit.

Where Can You Use This Report?

- Filing your tax returns

- Sharing with your accountant or tax professional

- Submitting during a tax audit

- Personal record-keeping and financial planning

The Schedule VDA Report is one of the most powerful tools to simplify crypto taxation. It consolidates all your trades, profits, and disposals in a transparent format that both you and your tax authority can understand. Whether it’s spot trading or derivatives like futures and options, the report ensures you know exactly what your taxable outcomes are.