How To Change Tax Method on Koinx Dashboard

Different tax procedures can significantly alter how your profits and losses are reported, potentially changing your tax obligations. Whether you want to maximise your tax strategy or comply with specific rules, you must keep your tax settings current. Calculation errors cause issues throughout tax season if you don't use the right method.

Fortunately, modifying your tax method is simple and easy. KoinX's user-friendly platform makes it easy to choose the best tax method for your needs. With a few simple steps, you can verify that your cryptocurrency transactions are handled effectively, keeping your financial records aligned with your selected approach.

Things to Keep in Mind While Changing Tax Method:

- The tax type you choose directly impacts your capital gains calculations.

- Changing your accounting method may affect previous tax reports, so choose the correct method before proceeding.

- If unsure, speak with a tax specialist to set up the most effective method for your requirements.

Follow this step-by-step guide to modify your tax method with ease.

Log in to Your KoinX Account

Please log in to your KoinX account if you have not done so yet.

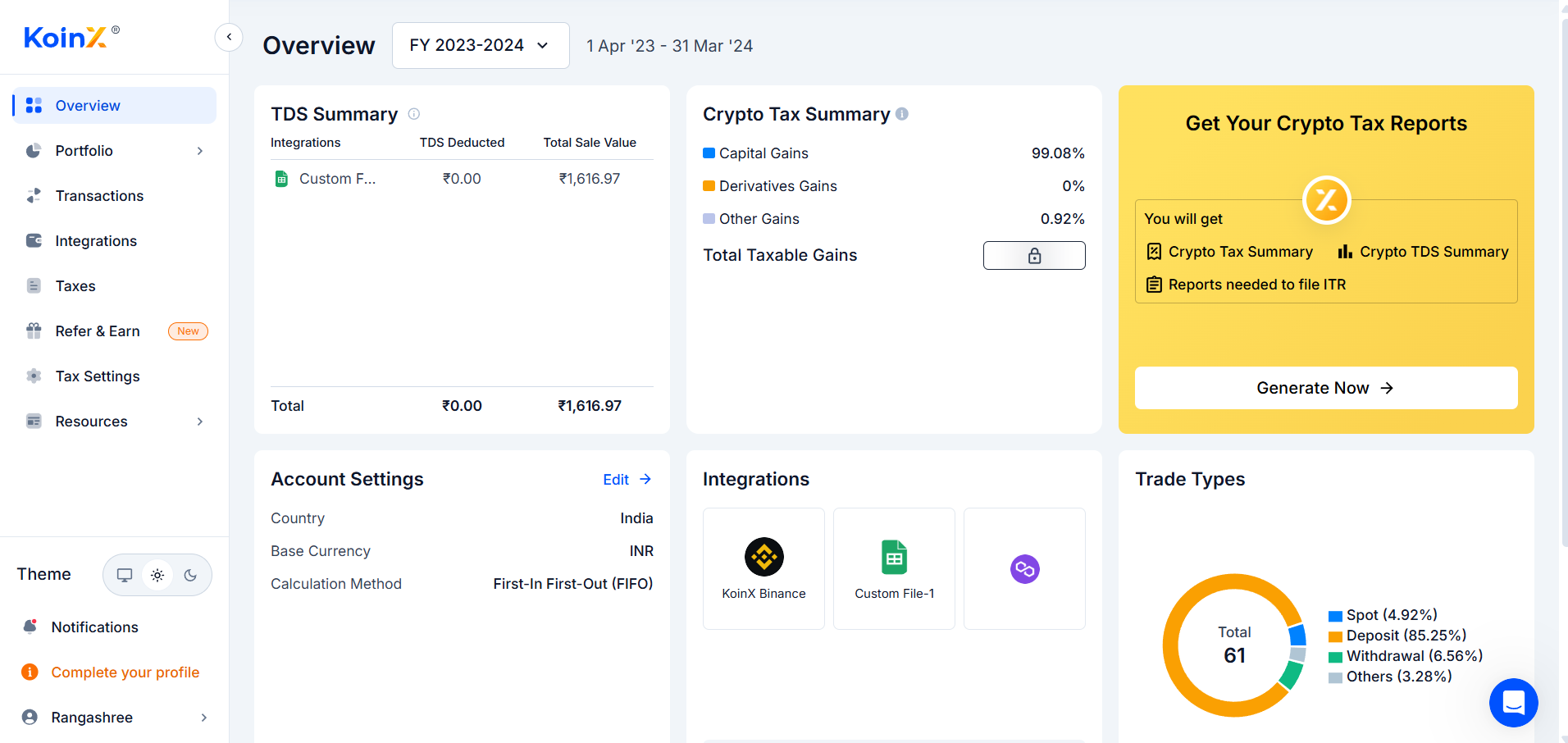

Access Your Overview

- After logging in, you will be directed to the Overview page of your profile.

Here you can have a look at your Crypto Tax Summary.

Go to the Tax Settings Page

- Select "Tax Settings" present on the left side of your screen.

This opens a page for tax settings.

Select Your Accounting Method

- Select an accounting method from the dropdown menu.

- After you select, you will see a listing of available accounting methods.

Choose Your Preferred Tax Method

- Scroll through the list to find the tax method that best meets your financial reporting requirements.

- Common methods include FIFO (First-In First-Out), LIFO (Last-In First-Out), and HIFO (Highest-In First-Out), depending on your registered country's tax rules.

Confirm and Save Your Option

- After you've chosen your preferred tax method, a confirmation request will appear.

- To finalise the modifications, click "Proceed".

- Your KoinX dashboard will now use the new accounting technique for any future tax calculations.

Why Change Your Tax Method?

- Tax Compliance: Ensures compliance with county tax requirements.

- Optimised Tax Strategy: Minimises taxable gains through various accounting strategies.

- Accurate Financial Reporting: Accurate profit and loss estimates for cryptocurrency transactions.

Follow these simple steps to adjust your tax accounting method on KoinX easily. This ensures your transactions are processed accurately and your tax reports are optimised. Simply follow the above steps to make the switch and keep your tax records accurate.