How to change your country on KoinX

To generate a tax report that complies with your country’s tax regulations, it’s crucial to ensure the correct country is selected in your KoinX settings. This not only provides accurate tax calculations but also enables seamless integration with exchanges and location-specific services.

Some exchanges apply regional restrictions or offer different features based on your country, so updating this information helps you stay compliant and get the most out of your portfolio management tools.

Here’s a step-by-step guide to help you through the process:

Sign in to your KoinX account

- Go to KoinX (opens in a new tab) and log in.

- Sign up and verify to access the account.

Access your profile

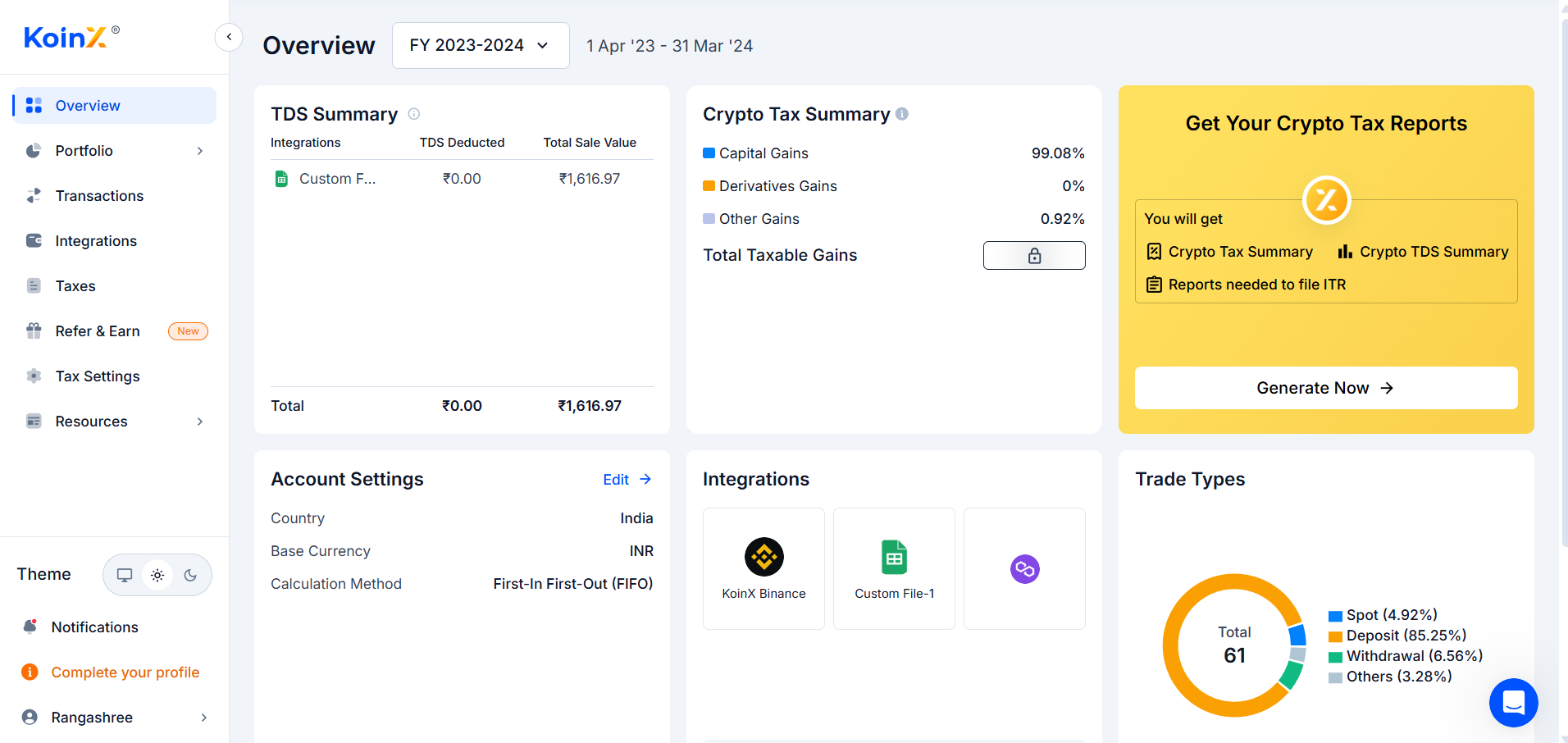

- You’ll be taken to your Dashboard to view your crypto tax summary.

Go to Tax Settings

- Select "Tax Settings" present on the left side of your screen.

This opens a page for tax settings.

Select Country from the Dropdown

- Find the "Country" dropdown under Tax Settings

- Click on the dropdown menu to see supported countries.

- Click your home country or the one where you want your tax settings to apply from the list.

KoinX will automatically adjust your tax and transaction settings depending on the specified country's tax rules.

Following this easy process, you can effortlessly update your tax and transaction settings on KoinX to align with your country’s regulations. Updating these settings ensures your reports are accurate and your tax filing goes smoothly.