grow your business

Our Core Features

KoinX enables tax professionals and accounting practices with right solution to upscale your crypto tax offering effortlessly and grow your business.

Increase Revenue up to 60%

Supercharge your accounting and consulting service with KoinX enabled crypto tax offering. With this solution -

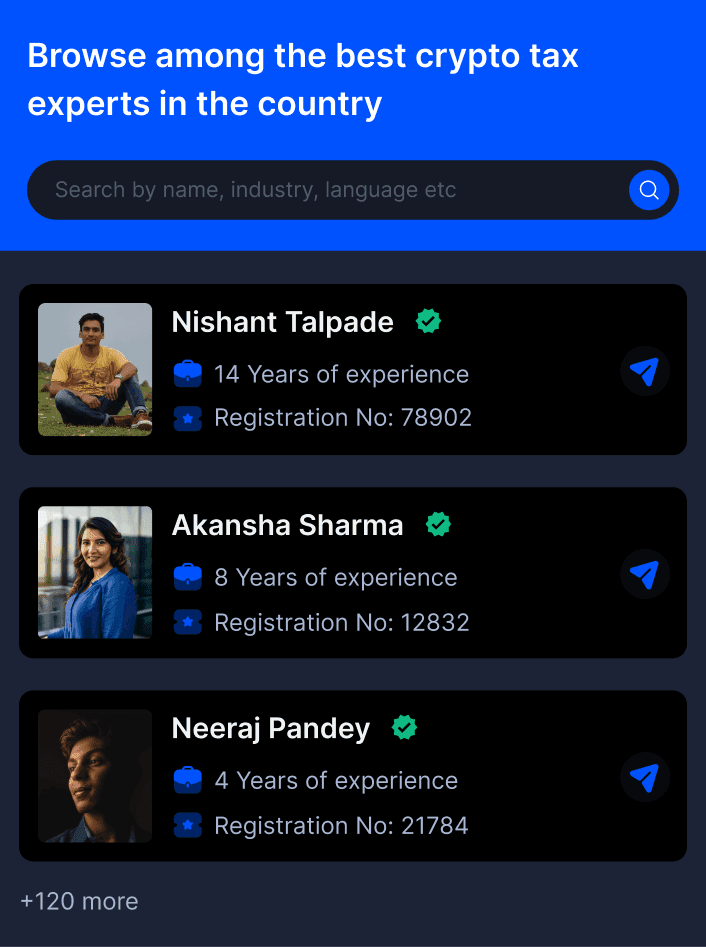

- Get listed in our tax professionals directory and acquire new clients

- Upsell your existing client base with real-time cryto tax calculation on top of traditional accounting service

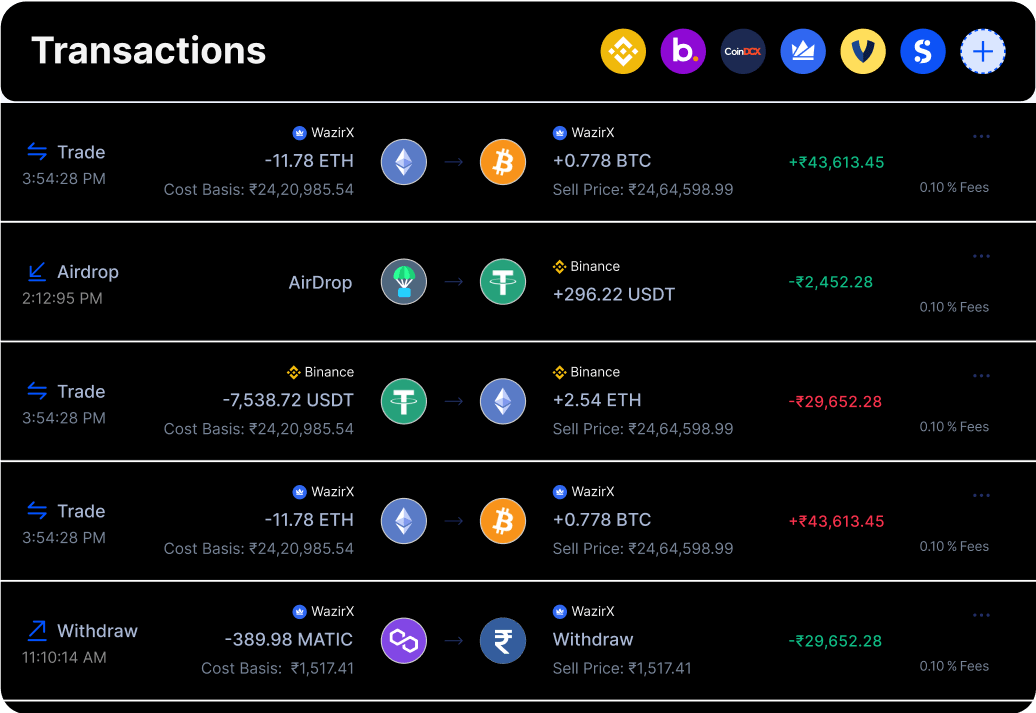

Sync Transactions Across Sources

You don’t have to worry about collection and reconcilation of data. KoinX automatically syncs all transaction from your individual client profiles with deep exchange integrations. Compatible with -

- 17,000+ cryptocurriences

- 200+ exchanges

- Trades and P2P transactions

Stay Compliant and Ahead of the Curve

Hassle-free experience of previewing and downloading tax reports for your clients all the year round and boost crypto tax accounting efficiency. Our real-time generated reports are -

- TDS Compliant

- Advance Tax Compliant

- ITR Compliant

Make more money for your practice, starting today

Onboard for free and start generating reports in minutes

Backed by

Entrepreneurs, CXOs and Business Leaders of World's Leading Companies

Sandeep Nailwal

Founder - Polygon

Siddharth Malik

Global CEO - CleverTap ex-Chairman, CRO - FreshWorks

Navin Gupta

Managing Director - Ripple

Utsav Somani

Partner - iSeed

Maninder Gulati

Global Chief Strategy Officer- OYO

Ajeet Khurana

ex-CEO ZebPay

Frequently Asked Questions

I have only made losses in crypto. Do I still need to file taxes?

How can KoinX help?

How are cryptocurrencies taxed?

Can I offset crypto losses against income?

Do I have to pay taxes on transferring cryptocurrency between my own wallets?

Are there global regulations for crypto-to-crypto transactions?

Can I reduce my crypto tax liability?

What is the capital gains tax on cryptocurrencies?

How do I keep track of my crypto transactions for tax purposes?

Are there any tax deductions or exemptions for cryptocurrency gains?

Are cryptocurrency regulations consistent worldwide?

How can I calculate my cryptocurrency gains and losses?

Supercharge your business with KoinX

Upskill, attract new clients, and provide better solutions to your existing clientele, only with KoinX.

![[object Object]](/_next/static/media/ISO_27001-2022_certification.ae776691.svg)

![[object Object]](/_next/static/media/GDPR_Compliance.a2dc5933.svg)

![[object Object]](/_next/static/media/SOC_2_Type_II_certification.dd69381e.svg)