Capital Gains & Crypto Income Report

Simplify Your CryptoFinances

Stop struggling with crypto tax calculations and Accounting. KoinX automatically processes your transactions, calculates capital gains, and helps you stay organized across your crypto activity.

Trusted By Leading Platforms

Built For Scale, Made For You

Complete Crypto Financial Solutions

Everything you need to manage, track, and optimize your digital assets.

For

Crypto Tax Platform

Capital Gains & Income Reports

Capital Gains & Income Reports Customizable Tax Settings

Customizable Tax Settings Accurate Cost Basis & Gain Calculations

Accurate Cost Basis & Gain Calculations Free Portfolio Tracking

Free Portfolio Tracking

Rated 4.5/5 by over 10.5k users

Listen to what users saying?

Built to Handle Crypto at Global Scale

Global Compliance

Trusted by 1.5M+ users across 100+ countries. Stay compliant with global crypto tax rules.

View Countries List

Enterprise Security

Your data is protected with enterprise-grade encryption and global compliance standards.

Know More

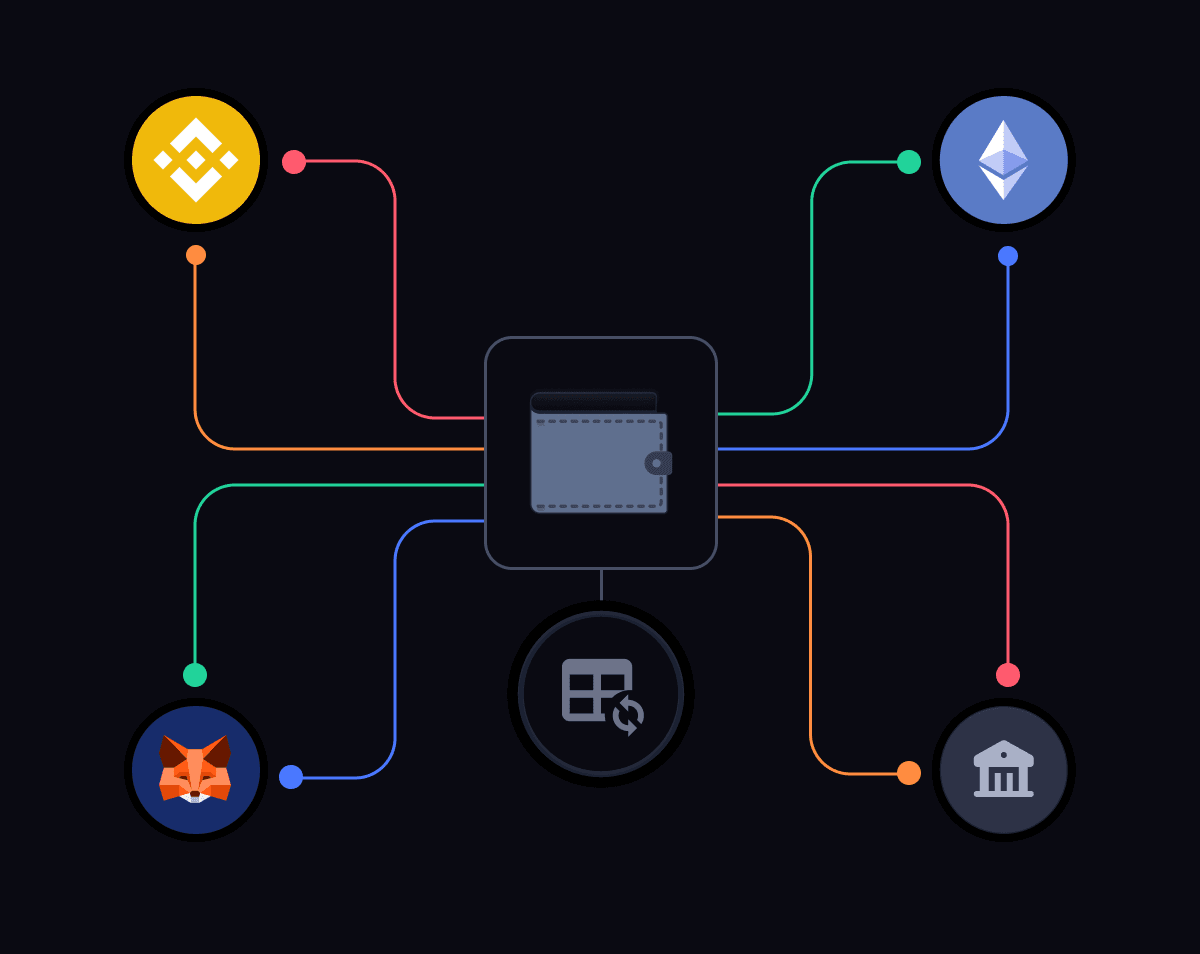

Extensive Integrations

Connect with 800+ exchanges, wallets, and blockchains in one place.

View All Integrations

Every Trade, Wallet and Chain Unified, Captured, & Processed.

Our intelligent engine processes every transaction, analyzes your portfolio, and generates fully compliant reports for individuals, businesses, and professionals.

Transaction Consolidation

Analysing

Analysing

Importing Transactions

Detecting inter-wallet transfers

Tagging transaction types

Fetching Prices

Preparing tax & accounting reports

Smart Analytics

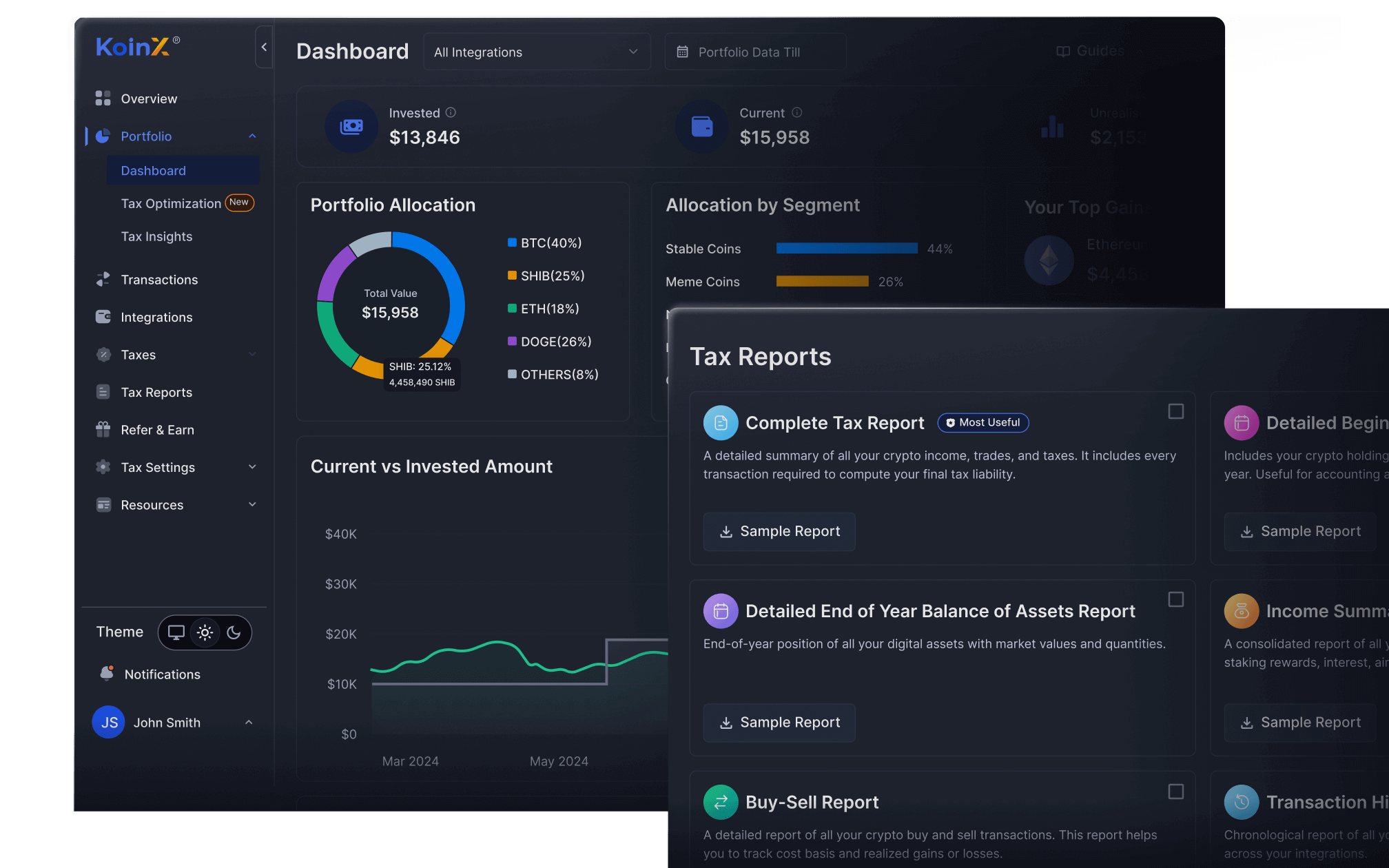

KoinX Tax

Filing-Ready Crypto Tax Reports

Detailed Portfolio and Tax Analytics

Tax Optimisation Insights

KoinX Books

Detailed Accounting Reports

Chart of Accounts, Journals and Automation

Multi-entity Accounting Management

Automated Insights and Reports

Built for the Way Crypto Finance Actually Works

From internal transfers to complex transaction categorization, KoinX handles the details accurately and automatically.

Internal Transfers, Handled Correctly

Automatically detect transfers between your wallets and exchanges, eliminate duplicates, and maintain accurate cost basis across all your accounts.

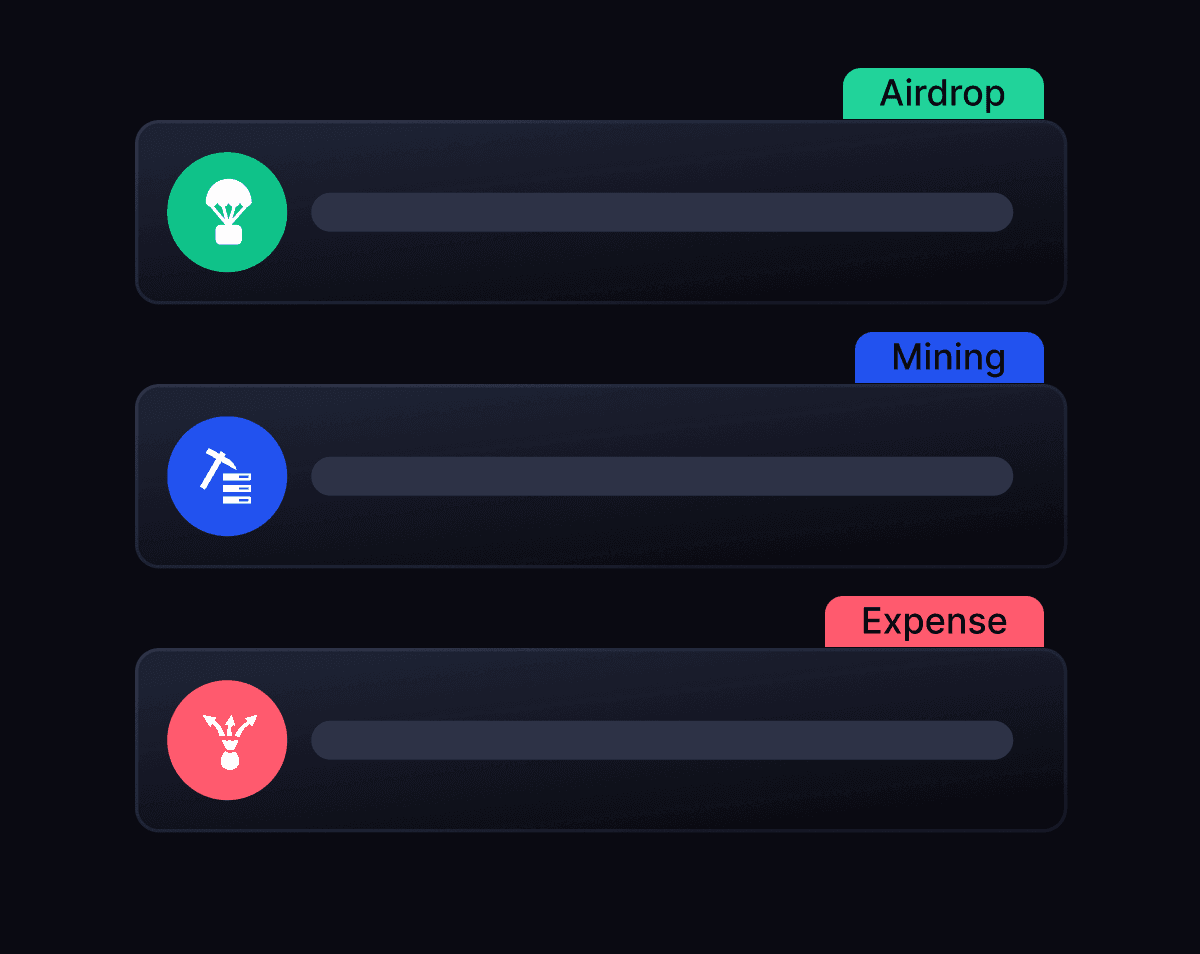

Every Transaction Classified Correctly

From staking to airdrops, mining to NFT trades—KoinX tags each transaction instantly so your tax and portfolio calculations stay 100% accurate.

Unify Your Entire Crypto Portfolio

Monitor holdings across chains, exchanges, and wallets with real-time analytics, performance insights, and complete asset visibility.

Frequently Asked Questions

KoinX Knowledge Hub

Take Control of Your Crypto Finances

From crypto taxes to accounting, KoinX helps you manage, track, and stay compliant and to end.